The cyclical dilemma faced by Chinese commercial vehicle parts enterprises

Release time:

2024-12-27

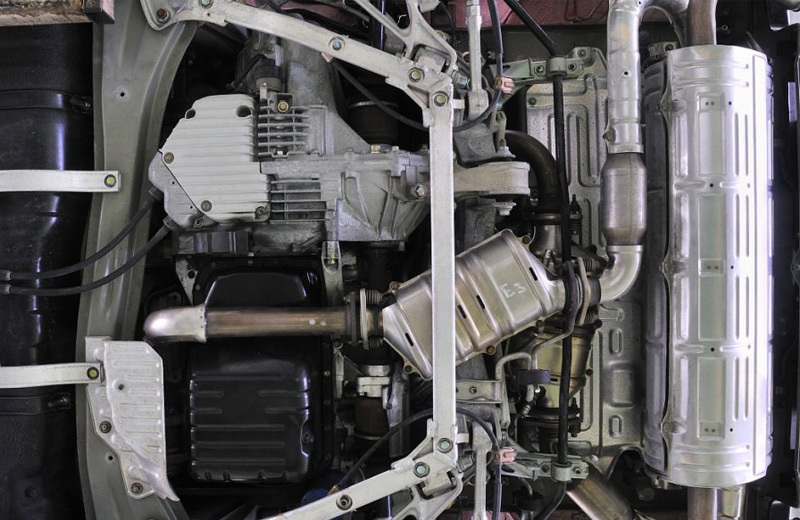

Commercial vehicle parts companies are a highly segmented industry, mostly emerging individual enterprises. For these small and medium-sized enterprises, the initial investment pressure is already very high, and the profit after production is not high, so it is relatively difficult to make them increase their investment in research and development. Moreover, during a certain period of time, the prices of raw materials for auto parts continue to rise, and enterprises need to pay a large portion of funds in terms of raw materials.

The marketing singularity is due to the limited regional segmentation of commercial vehicle parts enterprises, which determines that they can only maintain customer relationships through a point-to-point model. The issue of funding also determines that spare parts companies find it difficult to invest heavily in technology research and development. The nationwide redundant construction has plunged spare parts enterprises into the quagmire of price competition, resulting in serious capital waste. A complete cake is fragmented, making it difficult to form large-scale production, resulting in a low level of profitability and difficulty in investing heavily in subsequent research and development.

However, despite the many problems faced by commercial vehicle parts companies, the key to their survival still lies in the demand pull from vehicle manufacturers. After all, the parts produced by enterprises have relatively low technological content, and in terms of labor and manufacturing costs, there are still relatively few requirements for liquid assets.

The problem of path selection in vehicle manufacturers is also an important reason for the current difficulties faced by spare parts enterprises. Most domestic commercial vehicle companies produce products of any model or type, which is not conducive to product segmentation, and thus not conducive to the segmentation of automotive parts companies, nor is it conducive to parts companies focusing on a specific segmented product. Most companies only focus on current production and do not attach importance to the protection of intellectual property rights. Some commercial vehicle spare parts, even if they have technology and products, do not have patents, and they do not even understand what patent protection is.

Of course, the low-end technology and meager profits of commercial vehicle spare parts enterprises are also related to the characteristics of commercial vehicles themselves. Commercial vehicles are different from passenger cars. Commercial vehicles are an investment tool, and customers focus on their cost-effectiveness when purchasing. As long as it is sturdy and durable, the purchase cost can ultimately be effectively offset by the value created during use. So commercial vehicles have fewer requirements for the refinement of spare parts configuration and lower requirements for technical content. But another reality is that the demand for refinement in commercial vehicles is also gradually emerging. Some foreign commercial vehicle giants have already begun to refine their requirements in terms of configuration. During a certain period of time, many large foreign commercial vehicle companies have entered the domestic market in large numbers, posing significant challenges to domestic commercial vehicle enterprises. What component companies should do during a certain period of time is to optimize their structure, enhance their technological competitiveness, and strengthen their market channel development capabilities.

Due to the lack of necessary follow-up funds to expand production capacity and insufficient funding to support research and development, most spare parts companies are still limited to a point-to-point marketing model, making it difficult for them to break out of regional markets and become well-known spare parts enterprises. Commercial vehicle parts companies that are difficult to achieve great success are still struggling in the era of low profits. For a certain period of time, automotive parts companies have fallen into two vicious circles that are difficult to get rid of: one is the severe local protectionism, which has led to one-on-one marketing for parts companies, insufficient market development capabilities, and difficulty in forming economies of scale. Therefore, they have no decision-making power in the entire commercial vehicle industry chain and have completely become contract factories; Enterprises are addicted to low price competition and do not pay attention to intellectual property protection, which in turn increases local protectionism. The second vicious cycle is that low technological content leads to low profits, which in turn makes it difficult to sustain research and development funds, and in turn leads to low technological content.

As the foundation of the automotive industry, automotive components are necessary factors to support the sustainable and healthy development of the automotive industry. Especially in the current booming and vigorous development and innovation of the automotive industry, a strong component system is needed as support. The independent branding and technological innovation of whole vehicles require components as the foundation, and the independent innovation of components has a strong driving force for the development of the whole vehicle industry. They interact and influence each other. Without the independent branding of whole vehicles, the R&D and innovation capabilities of a strong component system are difficult to unleash. Without the support of a strong component system, the growth and development of independent brands will be difficult to sustain.

From January to December 2005, all automobile parts and accessories manufacturing enterprises in China achieved a cumulative total industrial output value of 383800952 thousand yuan, an increase of 18.67% over the same period last year; Accumulated product sales revenue of 375265815 thousand yuan, an increase of 20.21% compared to the same period last year; The total accumulated profit was 21462002 thousand yuan, a decrease of 9.09% compared to the same period last year.

Latest News

Get a Free Consultancy

CONTACT US

Building B4, High-tech Industrial Park, 3177 Yuehe Road, Weifang Economic Development Zone, Shandong

Quick Navigation

Copyright©2024 Shandong Xiangying Tek Machinery Co., Ltd.